By John DePutter & Dave Milne, DePutter Publishing Ltd.

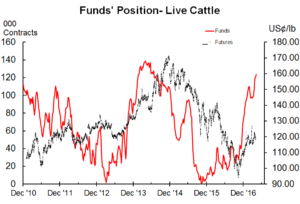

Cattle prices have been on the rise for about five months. The comeback has occurred following the severe, merciless bear market that pounded beef producers to the mat during most of 2015 and the first three quarters of 2016. The trend higher has been a welcome relief.

Is the comeback over? Is it time to get ready for a wave down?

Here are some indicators we’re watching that should make producers a little nervous that lower fed cattle prices are quite possible.

Seasonal odds: Lots of years in the past have seen prices decline from March or April, into the July-August lows. The chart below shows this tendency.

Inability to continue higher after Brazilian meat packer scandal: Most cash markets in Canada and the US were firm to higher immediately after news broke around the middle of last month that large packers in Brazil were suspected of inspection transgressions. Several countries temporarily suspended imports. But now the scandal has died down. The markets have been unable to keep running with the bullish ball lobbed by the allegations. A truly strong market would have been able to keep going, with or without the scandal.

Big bounce off the floor – can we reasonably expect more? US cash markets bottomed in mid-October 2016 and rallied into mid-March 2017. That five-month upswing re-captured about 44% of what the bear market of 2015 and 2016 took away. This is a respectable bounce up from the floor. It is common in the commodity world to see a retracement such as this, before a turn back toward a major low. To expect a lot more upside might be wishful thinking.

Lots of supplies out there: We all know cattle numbers in the U.S. are expanding. We know there’s lots of beef, pork and poultry coming as well. Our previous reports have covered the supply side data. The latest in this regard is a USDA hogs and pigs report which pegged the market hog inventory up 4.4% from a year earlier and the breeding herd up 1.5%. Sure, domestic demand is good, export demand is growing, but we need to remind ourselves of record total meat production too.

How about the futures market? Any clues there?

Here too, we see some warning signals. But the warnings are not alarming.

First, consider this: Like cash cattle, futures are also up sharply from the bear market low. Nearby live cattle futures bottomed Oct. 16 and started higher after that. If March 22 was the end of the rally, that would be a little over 5 months. The rally from October to March was $31.15/cwt, roughly a 40% retracement. As with cash markets, that’s a sizeable bounce. It is possible that this represents the end of the reaction up off the low.

Something different though: Main thing we see in futures is their continued discount to cash markets. That means you could see steady futures from here but lower cash prices, as cash moves down to come into line with the futures markets. Point being, futures are already accounting for lower cash cattle ahead. Do futures need to fall further to account for even deeper losses in cash cattle? Maybe not.

April future at press time was $119.42; June $110.70; Aug $106.80; Dec $107.47; Feb 2018 $107.70.

Conclusion:

Time to start being cautious about the cattle markets.

What we’re watching from here, for further signals:

We mentioned last edition that we were watching for chart signals that might hint futures were topping. Futures were strong right after that report went out, but there was no follow-through. They haven’t done very well the past week.

However, the trend is still up. From here, if the June future falls below approximately $108, thereby breaking the uptrend line shown, that might be a chart signal it is in for a deeper break.

Bottom line, although caution is in order for the cash-market outlook, the futures market’s signals are not bearish at this time. Futures are so discounted to cash, they don’t have the same downside risk.

Brought to you in partnership by: