By John DePutter & Dave Milne, DePutter Publishing Ltd.

If misery really does love company, then North American livestock producers can certainly commiserate.

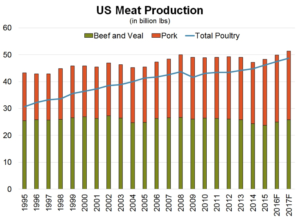

Because it’s not just cattle producers who are suffering through a glut of heavy supplies and the resulting poor prices; their pork-producing counterparts are getting hammered as well. Throw in the fact that poultry supplies are record heavy as well and you have the perfect storm. With so much meat available on the market, it’s no wonder prices have collapsed under the weight.

Bearish hogs and pigs report

The latest bad news for the meat complex came on Sep. 30 in the form of the latest USDA hogs and pigs report. That report pegged the total number of hogs and pigs in the U.S. as of the first of the month at 70.9 million, up 2% from the year earlier level and well above pre-report expectations. The breeding herd and the market hog inventory also topped trade guesses, helping to ensure the hog market will remain under pressure for the remainder of this year and likely beyond.

Indeed, the heavier hog numbers come at a time when weekly U.S. slaughter numbers are already as much as 8% above the year-earlier level, and the industry is flirting with the possibility the number of hogs coming to slaughter may actually exceed processing capacity. The last time that happened was in 1998 when prices plunged into the single digits.

Too much beef

Meanwhile, there’s plenty of beef around too. The U.S. beef cow slaughter is up about 18% since the spring, and the USDA’s September cattle on feed report showed 15.1% more cattle were placed into feedlots during August than the same month the previous year. At the same time, the USDA’s monthly cold storage report pegged the amount of beef in nationwide coolers as of the end of August at just over 476.6 million lbs, a 7-million lb increase from the end of July and coming at a time when supplies typically decline rather than get bigger.

In total, commercial red meat production in the U.S. totaled 4.43-billion lbs in August, up 14% from the 3.9 billion lbs produced the same month the previous year. Beef production, at 2.26-billion lbs, was up 17% from August 2015, while pork output was up 10% at 2.15 billion lbs.

Looking ahead to 2017, the USDA is projecting total red meat and poultry production for the year at 110.24 billion lbs, up from this year’s forecasted total of 97.55 billion.

Key message

The bottom line is meat supplies are universally heavy. And while poultry, pork and beef are obviously all different meats, how one is priced compared to the other can certainly impact demand. If pork prices are unusually cheap versus beef, then more consumers are more likely to opt for the less expensive meat in the grocery store – leaving the more expensive option behind.

If there is any good news for now, it may be that all those low prices are doing the job of generating extra demand. July U.S. beef export volume (the latest month for which statistics are available) increased 8% from a year ago to 99,341 tonnes – the second-largest monthly total this year – while pork shipments grew 8% to 180,547 tonnes.

Darkest before the dawn?

A secondary slice of good news comes from the over-supply of bad news. In commodity markets it might be said the worse the news gets, the better it is, because when the general outlook seems hopelessly bad, that’s when markets tend to bottom.

Same time though, cattle futures charts don’t show clear bullish reversal signals for the latest step down. Futures plummeted to levels of technical importance on long-term charts – we had previously expected some support to click in around $100 – but didn’t stop there. The nearby Oct future recently sliced under that round number, trading below $98 today (Oct. 3). If the market is going to respect the general support in the approximate $100 zone, it had better act fast.

Be aware, bear markets don’t last forever. In the livestock business, the more severe they are, the sharper the faster the bottom can be. The bear trend from the Nov 2014 all-time high of US$172.75 to its current position means that in less than two years from Nov 2014 to now the US market has lost what it took four years to gain. Such a hard and deep slam implies that when the market does finally max out to the downside, the bounce could be sharp and surprising.

Cattle futures are historically known to post spike-type lows, as opposed to the type of slow, gradual bottoms such as grain markets tend to form. Futures are probably heading for a low of just such character. At the current date and time, it’s tough to say when and where.

Back to the misery loves company theme

Cattle may not get any help from hogs for a while yet. The seasonal crunch time for heavy hog deliveries is ahead. Pork producers may have been happy to see that hog futures avoided heavy losses in response to the Sept. 30 USDA hogs and pigs report, but part of the rationale for that solid performance is the deep discounts futures have had to cash markets.

Meanwhile, cattle are still showing a wide spread over hogs. There’s more risk hogs drag cattle down than cattle help hold hogs up.

The last word

Summing up, the trend is down as of press time. While the cattle market is in a position to post a sizable bounce, if only because of how far it has already come, we see no clear bullish reversal signals or solid bottoming action as this is written.

Things could get worse before they get better – but don’t go to sleep because when the turn comes it could be swift.

Brought to you in partnership by: